Honestly, even the words “tax filing” scare people a little. There are too many forms and rules. It gets confusing very fast. But by 2026, there’s some genuinely good news. AI tax preparation tools have made this entire process far easy and less stressful.

Today, tax preparation automation is not only limited to large corporations. Freelancers, small business owners, and salaried professionals are now using AI-powered tax software to manage automated tax filing stressfree. It saves time, reduces errors, and avoids unnecessary headaches.

Therefore, we will take a closer look at 10 AI tools for tax preparation automation that truly deliver. These tools are reliable, widely used, and designed to meet US tax compliance requirements without making the process complicated.

1. TurboTax AI

For many people, TurboTax feels like a safe zone when it comes to taxes. In 2026, its AI will become really smarter. It asks questions in such a simple, guided way that even if you don’t fully understand taxes, filing feels easy.

The chances of missing deductions are very low. If you run a small business or have a side hustle, this is easily one of the best AI tax software options for small businesses.

2. H&R Block AI Tax Software

H & R Block AI Tax Software combines professional expertise with advanced Tax Automation Tools. Its AI engine reviews past tax data to suggest smarter filing strategies and improve future tax planning. This makes it more than just a filing tool, it also functions as effective AI Tax Planning Software.

It’s the best option for users who want the reassurance of professional-grade tax compliance software along with modern automation. Small business owners often consider it one of the Best AI Tax Software for Small Business due to its balance of accuracy and support.

3. Sage AI

Sage AI is a powerful solution for businesses that want tax and accounting handled together. As one of the most advanced AI Accounting Tools, it simplifies financial management while ensuring accurate tax calculations. In 2026, Sage AI has become a strong Tax Automation Software for medium and growing enterprises.

It continuously analyzes real-time financial data to support Automated Tax Compliance. With built-in reporting and forecasting features, this software helps businesses make best decisions. If you’re looking for a professional-grade AI Accounting Software that delivers digital tax solutions, Sage AI is the perfect choice.

4. Xero Tax AI

Xero Tax AI is popular because it works on the cloud and keeps tax work simple. Xero is built to make tax compliance quicker and much easier to handle. It’s a good fit for startups and small businesses that want dependable tax automation without dealing with complicated features.

If you prefer a clean and straightforward tax tool, Xero Tax AI does the job well. For businesses aiming to maintain smooth US Tax Compliance, Xero Tax AI offers a modern and flexible solution.

5. Zoho Tax AI

Zoho Tax AI has earned a strong reputation as a Smart Tax Software that integrates accounting and tax automation. Its AI capabilities analyze financial data to identify potential savings and ensure accurate filing. In 2026, Zoho has expanded its Tax Compliance Automation features significantly.

Zoho Tax AI keeps accounting and tax filing in one place, so things don’t feel messy or confusing. It helps you file taxes on time and keeps everything organized, which lowers the chance of penalties.

6. TaxAct AI

TaxAct AI is a good choice if you want tax software that is easy to use and affordable. In 2026, its AI features have improved a lot and now guide users clearly at every step of the tax filing process. It helps you understand what to do next without making things confusing.

As a dependable AI-Based Tax Software, TaxAct AI ensures compliance with updated IRS regulations. It’s a solid choice for individuals and small businesses that want efficient AI Tax Preparation automation Tools without premium pricing.

7. FreeTaxUSA AI

FreeTaxUSA AI is good if you want to do your taxes and not spend much money. It quietly checks your details, finds small mistakes, and helps you feel sure before you file. By 2026, filing taxes feels easy, smooth, and not stressful anymore.

The platform also takes care of basic tax compliance, so meeting federal filing rules doesn’t feel stressful. It works well for individuals, freelancers, and small business owners who want simple and affordable digital tax solutions. If saving money matters to you, FreeTaxUSA AI offers solid results without unnecessary costs.

8. Credit Karma Tax AI

Credit Karma Tax AI has gained popularity for providing free and easy-to-use AI Tax Preparation automation Tools. The platform simplifies filing by automatically identifying deductions and credits using AI Accounting Tools.

Its Tax Automation Tools help users complete returns quickly while maintaining US Tax Compliance. Credit Karma Tax AI is especially suitable for individuals and small business owners who want straightforward Automated Tax Filing without added costs.

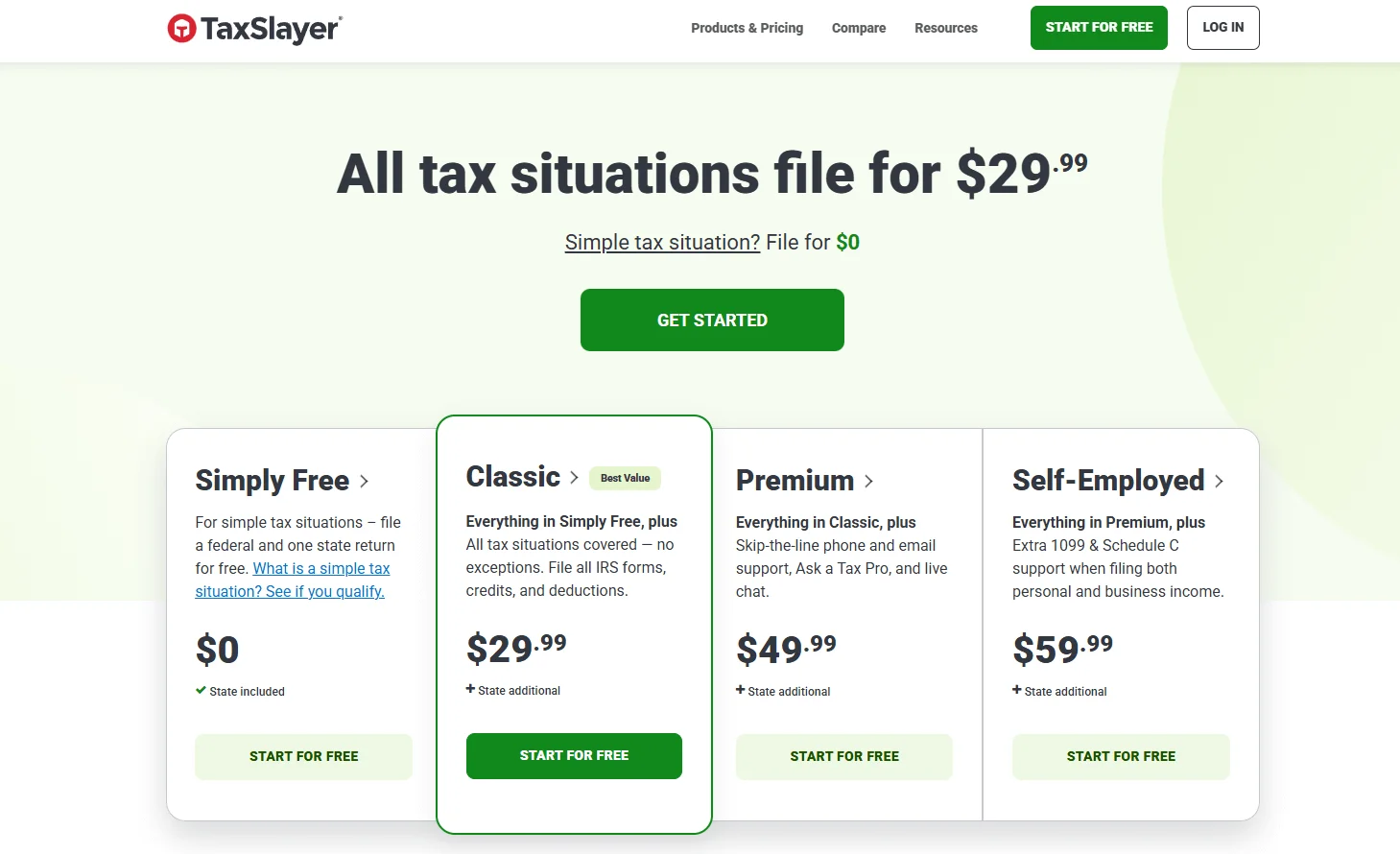

9. TaxSlayer AI

TaxSlayer AI has positioned itself as a reliable Tax Compliance Software with advanced automation features. The AI engine processes financial data efficiently, delivering accurate results in less time. This makes it a strong AI-Based Tax Software option for both personal and business use.

With effective Tax Automation Software, TaxSlayer AI helps reduce errors and speeds up filing. It’s a good fit for users seeking affordable yet dependable Digital Tax Solutions that support long-term compliance and efficiency.

10. Jackson Hewitt AI Filing

Jackson Hewitt AI Filing makes tax filing simple by combining smart automation with real human support. The software takes care of most of the tax work on its own, but if you ever get stuck, real experts are there to help. The AI stays updated with the latest tax rules, so your filing stays correct and compliant.

Because of this, it’s a good choice for individuals and small businesses who want to file US taxes without stress or confusion. If you’re looking for a solution that blends technology with personal guidance, Jackson Hewitt AI Filing is a solid option.

Conclusion

In 2026, doing taxes without AI tax preparation automation tools feels so old-fashioned. Today’s tax automation tools and AI accounting software make tax filing really safe and fast. Also, they reduce mistakes.

When you use the right AI tax software, you don’t have to worry about rules or dates. It does the hard work for you, so filing taxes feels easy and relaxed. Everything remains accurate and compliant. You can spend your time on your business or your personal finances instead of worrying about taxes.

Have any thoughts?

Share your reaction or leave a quick response — we’d love to hear what you think!